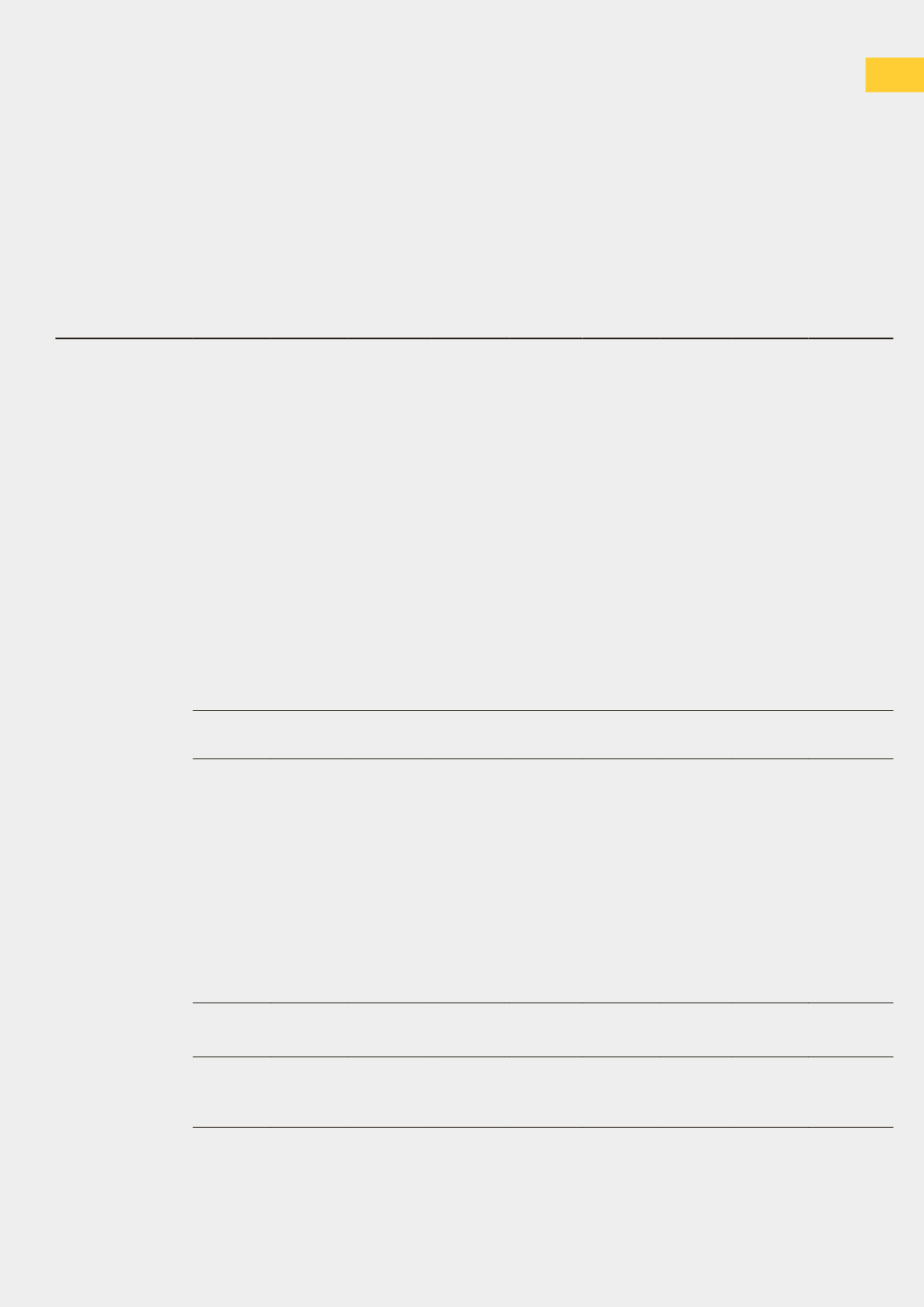

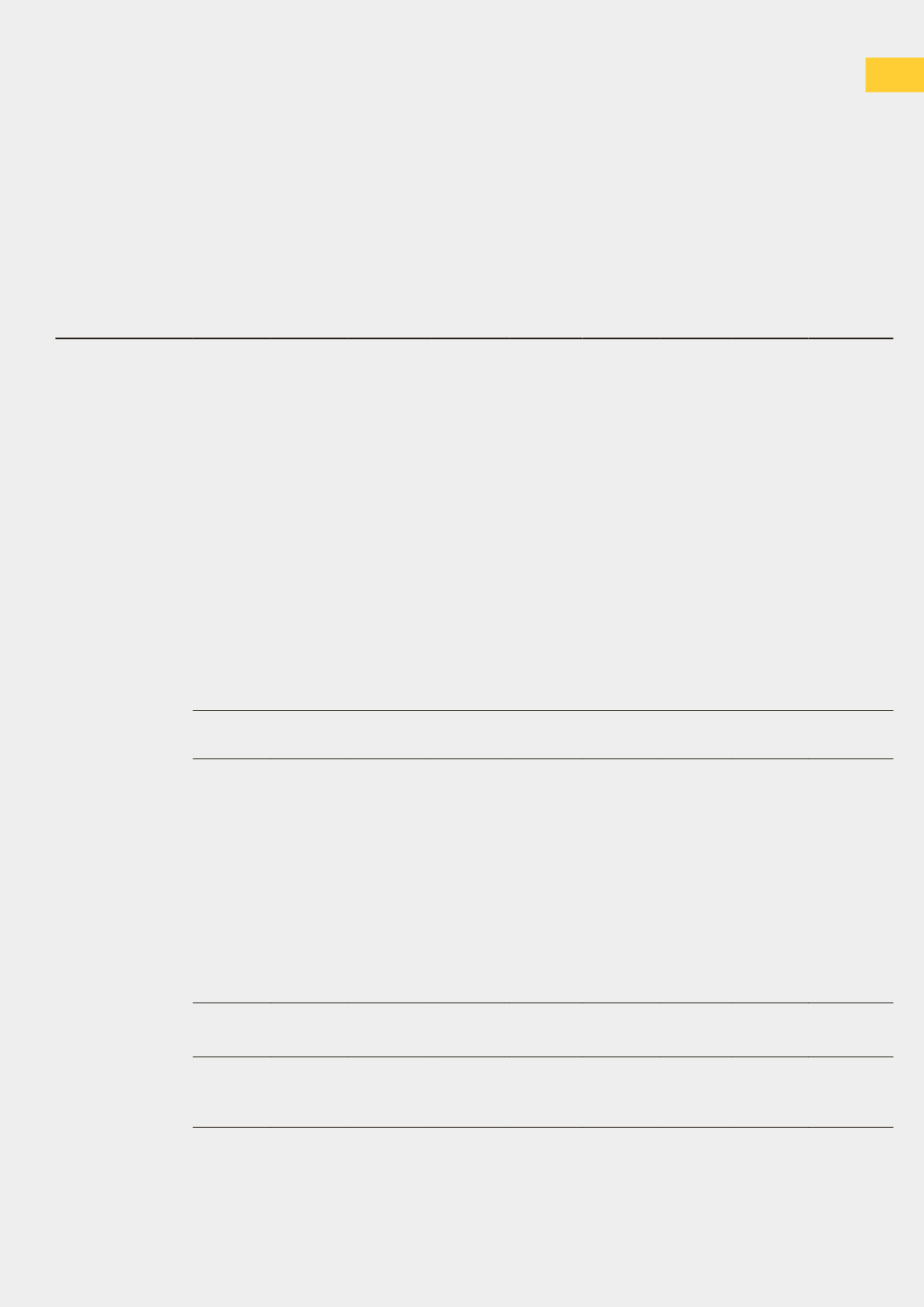

ANNUAL REPORT 2017/18 41

NOTES TO THE FINANCIAL STATEMENTS

31 March 2018

$’000 $’000

$’000 $’000 $’000 $’000 $’000 $’000

$’000

Cost

Balance as at

1 April 2017

1,955 209,718 554,280 45,189 3,423

7,328 11,681

218 833,792

Additions

665

-

7,749 15,082

656

215

436

186 24,989

Transfer

(1,621)

-

90 1,528

2

1

-

-

-

Reclassified to

intangible assets

(Note 15)

(88)

-

-

-

-

-

-

-

(88)

Reclassification

between

categories

-

-

1,785

-

-

- (1,785)

-

-

Asset written off

-

-

(3)

-

-

-

(279)

-

(282)

Disposals

-

-

(57)

(44)

(5)

-

(279)

(209)

(594)

Balance as at

31 March 2018

911 209,718 563,844 61,755 4,076 7,544 9,774

195 857,817

Accumulated

depreciation

Balance as at

1 April 2017

-

11,474 48,662 16,534 1,987

2,785 6,525

123 88,090

Depreciation

charge

-

2,119 22,857

9,159

877

1,061

614

22 36,709

Asset written off

-

-

-

-

-

-

(177)

-

(177)

Disposals

-

-

(57)

(28)

(5)

-

(222)

(138)

(450)

Balance as at

31 March 2018

-

13,593

71,462 25,665 2,859 3,846 6,740

7 124,172

Net book value

Balance as at

31 March 2018

911 196,125 492,382 36,090 1,217 3,698 3,034

188 733,645

Construction-

in-progress

Leasehold

Land

Buildings and plant

and machinery

Computer systems,

communications

and laboratory equipment

Personal computers

and equipment

Furniture

and fittings

Audio visual and

office equipment

Motor vehicle

Total

14. PROPERTY, PLANTAND EQUIPMENT