Increase in Overall Employment Rates and Starting Salaries for SUTD Fresh Graduates

* Mean gross monthly salary.

* Mean gross monthly salary.

+ Overall employment rate.

^ Based on the Economic Development Board’s list of Singapore’s industries and key activities.

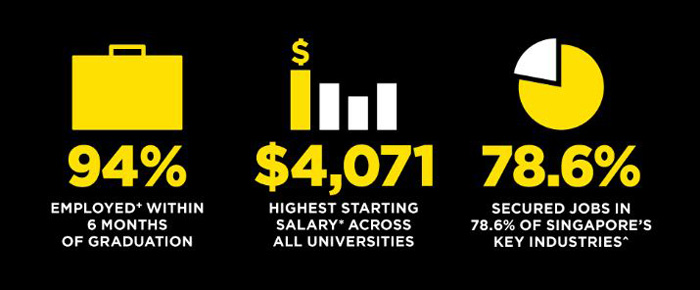

The survey, as at 15 February 2019, showed that SUTD continues to maintain high overall employment rates and starting salaries for its graduates for the fourth consecutive year. The overall employment rate increased by 2.6-percentage points, from 91.4% in 2017 to 94.0% in 2018.

The mean gross monthly salary among SUTD’s fresh graduates employed in full-time permanent employment increased to $4,071 in 2018, compared to $3,859 in 2017; and the median gross monthly salary was $3,850 in 2018, compared to $3,700 in 2017.

Some of the top hiring sectors include Information & Communication, Scientific Research & Development and Financial & Insurance.

"I am pleased that for the fourth consecutive year, our Graduate Employment Survey results show that SUTD graduates continue to be well sought-after by employers, enjoying high overall employment rates and starting salaries. This is further affirmation that SUTD’s multi-disciplinary, design-centric education nurtures our students with strong critical thinking, innovation and problem solving abilities, preparing them well for the jobs of tomorrow. Coupled with overseas exposure and internship experiences, we shape SUTD graduates into industry-, world- and future-ready talents for Singapore." — Professor Chong Tow Chong, SUTD’s President

334 fresh graduates and 76 follow-up graduates1 from SUTD were surveyed in February 2019 and the overall response rate obtained was 85.3% and 84.2% respectively.

SUTD: 2018 GES Employment Rates2 and Salaries of Graduates by Bachelor Degree

|

Degree

|

Overall Employment Rate3

|

Full-Time Permanent Employment Rate4

|

Basic Monthly Salary5

|

Gross Monthly Salary6

|

|

Mean

|

Median

|

Mean

|

Median

|

25th Percentile

|

75th Percentile

|

|

Bachelor of Engineering (Engineering Product Development)

|

94.7%

|

86.3%

|

$3,773

|

$3,700

|

$3,826

|

$3,700

|

$3,500

|

$4,000

|

|

Bachelor of Engineering (Information Systems Technology and Design)

|

97.3%

|

93.3%

|

$4,448

|

$4,300

|

$4,544

|

$4,400

|

$4,000

|

$5,000

|

|

Bachelor of Engineering (Engineering Systems and Design)

|

90.0%

|

90.0%

|

$3,798

|

$3,800

|

$3,893

|

$3,800

|

$3,600

|

$4,000

|

|

Bachelor of Science (Architecture and Sustainable Design) 1

|

95.1%

|

88.5%

|

$3,848

|

$3,900

|

$3,945

|

$4,000

|

$3,600

|

$4,215

|

Source: MOE’s Graduate Employment Survey 2018

Our multi-disciplinary, design-centric education shapes you into a modern tech leader. Be empowered to build a better career and a better world.

#ChooseSUTD

Notes:

1. Data on Architecture and Sustainable Design graduates are obtained from a follow-up survey on 2015 Architecture and Sustainable Design graduates after they have completed their practical training.

2. The employment rates refer to the number of graduates employed as a proportion of graduates in the labour force (i.e. those who were working, or not working but actively looking and available for work) as at 15 February 2019 (i.e. approximately six months after completing their final examinations).

3. Overall employment rate refers to the number of graduates working on a full-time permanent, part-time, temporary or freelance basis, as a proportion of graduates in the labour force (i.e. those who were working, or not working but actively looking and available for work).

4. Full-time permanent employment refers to employment of at least 35 hours a week and where the employment is not temporary. It includes those on contracts of one year or more.

5. Basic monthly salary pertains only to full-time permanently employed graduates. It comprises basic pay before deduction of the employee’s CPF contributions and personal income tax. Employer’s CPF contributions, bonuses, stock options, overtime payments, commissions, fixed allowances, other regular cash payments, lump sum payments, and payments-in-kind are excluded.

6. Gross monthly salary pertains only to full-time permanently employed graduates. It comprises basic salary, overtime payments, commissions, fixed allowances and other regular cash payments, before deductions of the employee’s CPF contributions and personal income tax. Employer’s CPF contributions, bonuses, stock options, lump sum payments, and payments-in-kind are excluded.